Work open positions have increased, however, thus gets the average credit debt

Debt consolidating in the Bakersfield (CA) helps you get money straight back on course. By the merging your financial situation on you to definitely payment, you’ll save cash on desire and you may costs as well as have aside from debt quicker. Two an approach to consolidate the money you owe is because of an alternative mortgage or because of the coping with a cards counseling service which will make a cost bundle. Any sort of choice you select, combining the money you owe will help you go back into strong monetary footing.

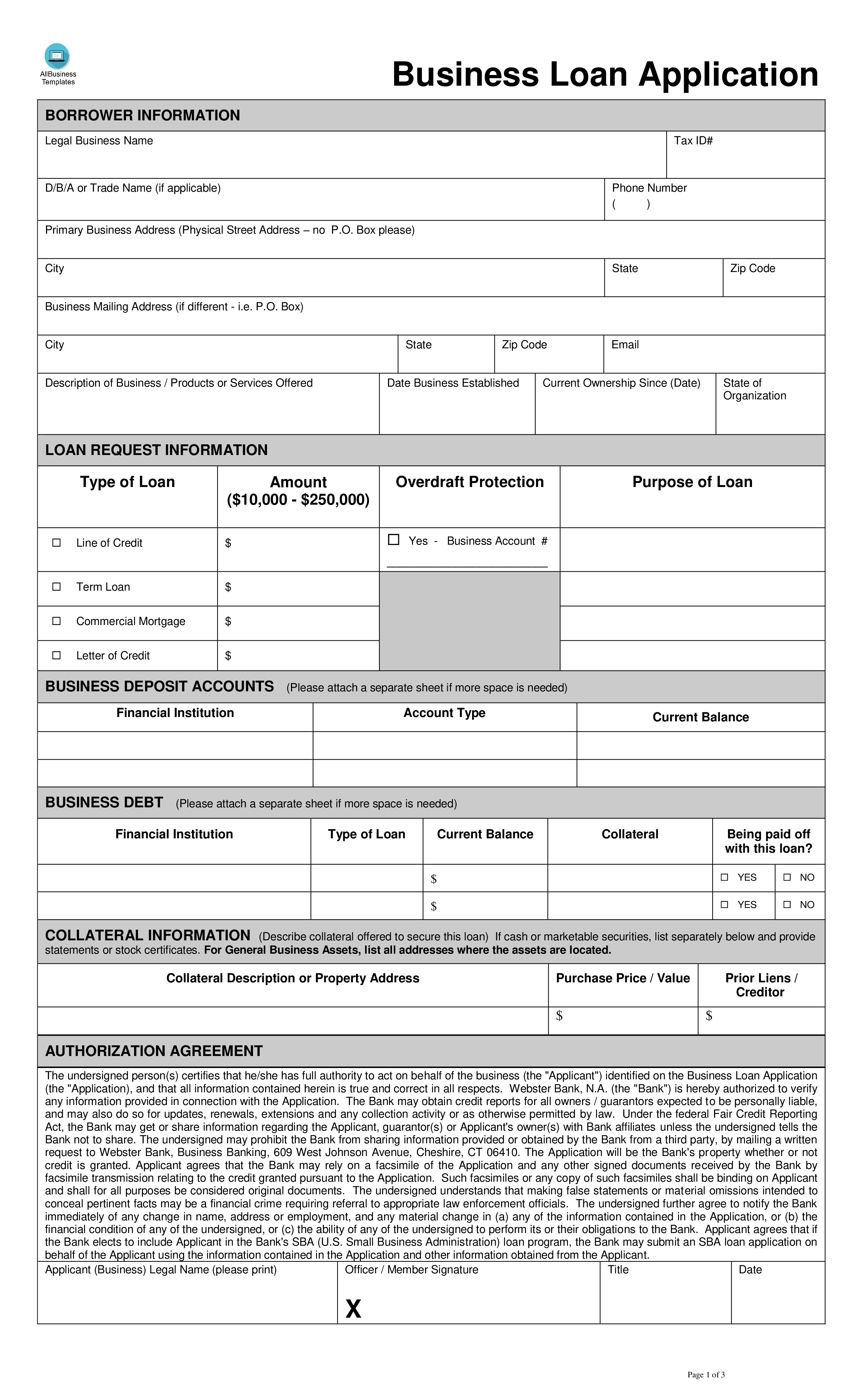

Better business bureau A beneficial+ Score Minimal Personal debt $ten,100000 No Minimal Credit rating $3 billion+ debt fixed Bbb An effective+ Score Award winning Loan Circle Loans from $2,500 – $fifty,one hundred thousand

This new pandemic has received a significant impact on the condition of California. In 2020, Californians had the average personal debt off $5,120, but by 2021 you to amount had risen up to $6,960. Brand new inflation causes it to be burdensome for residents so you’re able to pay their costs.

Bakersfield Ca

Kern Condition, Ca, hosts the town away from Bakersfield. The city ‘s the state chair and you will premier inside the Kern County, covering regarding 151 sq mi (390 km2). As Jacksonville installment loans no credit check of the fresh new 2020 census, Bakersfield’s people is 403,455. This will make it the fresh new 48th-really populous area in the united states therefore the 9th-most populous inside Ca.

Bakersfield is based around the southern area prevent of one’s San Joaquin Area and the Main Valley part. The metropolis are a hub for team and you will community inside California. It can be a heart for farming and you can agriculture.

Cost of living & Income

Predicated on 2019 estimates, this new average house earnings for the Bakersfield was $62,402. This can be somewhat greater than the brand new 2000 shape out of $39,982. statewide, California’s average household earnings is actually $80,440.

The expense of staying in Bakersfield is pretty reasonable versus other parts of the country. The average lease getting a-one-room apartment simply more $1,one hundred thousand per month, additionally the cost-of-living directory is actually 91.

Housing marketplace

According to previous estimates, the latest median value of property otherwise condo when you look at the Bakersfield, Ca, is $264,500. This will be right up off $103,500 inside the 2000 and you may significantly more than the newest statewide average really worth from $568,five hundred. Prices for most of the casing products for the Bakersfield averaged $281,203 inside the 2019, with isolated home averaging $293,493 and you may townhouses or any other connected systems averaging $172,246. Cellular homes averaged $46,546.

Although the houses drama from inside the Ca is getting worse, it is not just affecting major places including Sacramento and you will Fresno. Rental costs are growing annual, getting a strain to the citizens incapable of pay the bills.

Fees And you will Financial

Brand new tax costs to have residents off California can be quite different based on how much currency they make. A low rates is only step 1%, it can move up to thirteen.3% for those who earn one particular. Better yet, addititionally there is a state conversion process income tax off 6%. Regional governments for the California are also allowed to collect a location sales income tax all the way to step three.5%.

Research conducted recently has actually unearthed that 5.6% regarding Californians lack the means to access first economic characteristics instance checking or deals membership. This is certainly, even if financial is far more prominent when you look at the California than in other areas out of The united states. That it lack of availableness is certainly apply to individuals who have to use these services but never keep them.

Retirement In the Ca

Californians try shedding quick with the senior years offers. An average of, owners simply have $428,437 secured, much lower than all it takes in order to retire comfortably inside condition. Having a soft advancing years, experts recommend with at the least $step 1.5 billion conserved.

As increasing numbers of some one retire, he’s increasingly downsizing and moving to states that have a reduced cost of living. This is particularly true for those who rely heavily on the Societal Cover advantages, that make up a significant part of its money. On the twenty two% away from retirees believe in Personal Safety for 90% or maybe more of their total income.

Debt consolidating When you look at the Bakersfield, Ca

Carrying out debt consolidation in the Bakersfield (CA) is an excellent cure for reduce your monthly installments and you can help save cash on focus. In the place of and make independent payments to help you numerous credit card issuers otherwise loan providers each month, you can move her or him towards one to percentage from lender. This will help you get out of debt quicker and you will save yourself money in the long run.

- Auto loans

- Medical Personal debt

- Unsecured loans

- Pupil Obligations

- Credit cards

- Pay day loan