Get a beneficial ?2 hundred Financing in the united kingdom

?200 Payday loan Qualification Criteria

Finding a great ?2 hundred mortgage regarding Punctual Mortgage British? The qualification standards is simple. Youre this is pertain for people who:

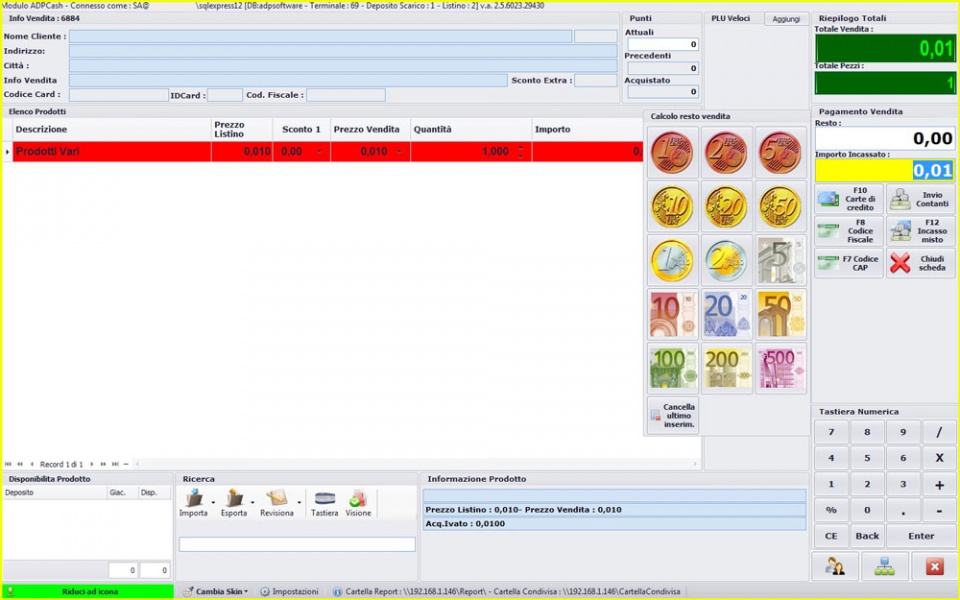

The application processes is not difficult and get done out of a pc, mobile otherwise pill anywhere you have access to the web. This is a lifesaver if you would like a beneficial ?200 loan inside an urgent situation; software program is short and you can, in the event that you are accepted, you could have the bucks inside ten minutes (for as long as the bank or strengthening people is process Faster Payments).

Simply online direct personal loans good credit visit our software webpage and select a beneficial 200 lb financing or even the direct number you need if this sounds like far more, otherwise faster, than good ?two hundred financing. Taking out increased mortgage than you want would mean your shell out much more appeal unnecessarily. We provide funds starting from merely ?fifty, for the increments from ?10, meaning their possible for you to definitely hold the price of your own mortgage off.

Next, you could potentially select whether youd need repay your own ?two hundred loan into the a single-off commission, otherwise having weekly otherwise monthly payments. You can buy the fees day your self i encourage complimentary it into the usual shell out day so you see youll usually have the money to afford repayments.

Eventually, select just how long youll need certainly to pay back your own ?two hundred payday loans. Having fun with our very own convenient computation device, you will see just how much their ?200 loan will surely cost monthly plus full as you change the loan amount and term, it is therefore an easy task to sign up for that loan that works well having your financial allowance.

Hit one pertain option while making a cup of tea. Whenever we you want any more guidance away from you to approve your ?two hundred loan, youll discovered an easy label from your private Customer support manager which shouldnt grab over 5 minutes. Read More