Fixed price compared to. variable rate home loan: which is ideal for me personally?

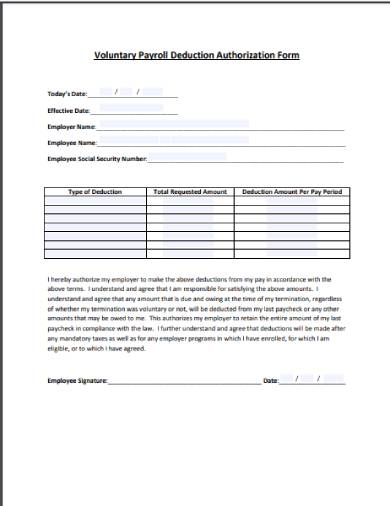

While there are many items from the play regarding the home loan americash loans Kittredge price, you can find affairs you could potentially handle. Of the trying to improve situations on your manage, you could commonly reduce your financial rates by a tremendous amount. Actually losing your rates by the a-quarter away from a per cent is help you save thousands of bucks during the course of new payment of the home loan.

Which have multiple mortgage models available, most are made to match other mortgage means. Five of the most extremely preferred versions were fixed price mortgages, changeable rates mortgages (ARMs), FHA finance, and you will Virtual assistant money. Keep reading more resources for all these loan versions.

FHA Loans

Federal Homes Management (FHA) Finance may help homeowners who do maybe not otherwise cannot make the traditional 20% downpayment and you will/otherwise possess a lowered credit score fund a home. That have a keen FHA loan, you might put down as low as 3.5% from the closure.

Va Loans

Virtual assistant funds are set aside to have veterans, active-duty staff, reservists, Federal Shield professionals, and regularly enduring spouses. So it mortgage need zero deposit and a capability to pick which have a less-than-perfect credit rating.

Fixed Speed Financing

Fixed speed financing certainly are the most common financing solution, together with extremely needed-out-by consumers. Because recommended throughout the title, the speed remains the same throughout the lifetime of the loan. Of several borrowers will start away which have a thirty-seasons repaired financing, however, there are many more alternatives for example twenty five-, 15-, and you may ten-12 months mortgage solutions.

Fixed rates fund bring sensible and you will aggressive rates of interest you to remain credit will cost you low. Read More