How to submit an application for a concept step 1 mortgage

Borrowing You ought not end up being outstanding or perhaps in standard on the various other federally recognized financing program (as exhibited of the a CAIVRS consider).

Money and you may work You really must be able to illustrate that you feel the earnings to settle the loan during the typical monthly installments and can look after an obligations-to-income (DTI) ratio regarding 45% or less than.

Zero assessment is required. Identity step one financing individuals including don’t need to take part in property guidance, that is you’ll need for some other federally recognized financing.

If you think an FHA Identity step 1 mortgage is good to possess your, it is possible to basic need certainly to look the new U.S. Institution out-of Property and you may Metropolitan Development’s (HUD) bank listing to possess approved loan providers near you. Brand new browse tool can help you narrow down the list to exhibit merely HUD-acknowledged loan providers in your area that provide Term step one financing.

After you’ve chose several to contact, the FHA Name step 1-recognized loan providers will guide you to sign up. You will have to prepare an in depth breakdown of your advised fixes, as the Title step one financing money can be used just to your works described on the app.

While having fun with a builder, offer your own financial a duplicate of your own proposition otherwise works contract that relates to brand new solutions as done and prices prices. If you are working on the project on your own, posting your own bank a written breakdown of your repairs, a textile listing and will loans Keystone cost you.

FHA Title step one finance advantages and disadvantages

Loose certification conditions. FHA Identity step 1 funds do not have set credit score criteria, and several kind of attributes meet the requirements having money.

No equity expected. Even though many do-it-yourself money depend on house security, these money can perhaps work getting property owners with little to no security.

Personal loans available. Fund regarding lower than $7,500 do not require collateral, definition your house is protected from the potential for foreclosure.

Zero prepayment punishment. As you won’t be penalized for paying the loan from very early, you’ll have far more freedom in how and if you could potentially shell out it off. Even just one more fee per year may cause large savings finally.

Need not be the majority of your home. In the place of almost every other FHA funds, Term step one finance do not require one to are now living in your house since your no. 1 house except if the property concerned is a beneficial are designed home.

Need certainly to fool around with a medication bank. Just FHA-recognized loan providers can also be matter Term step 1 recovery money. Whether your newest financial is not to the list, you simply cannot make use of them.

Must pay an insurance superior. This new FHA fees an upfront mortgage cost, that is step one.75% of one’s amount borrowed, and you can a continuing annual premium ranging from 0.45% to 1.05%, based on your loan-to-worthy of ratio (LTV) and you may financing term.

Need to limit spending to important fixes. If you find yourself family collateral money typically have couple strings affixed, Title 1 money can be utilized simply for new solutions in depth regarding loan application.

Solutions in order to an FHA Title 1 mortgage

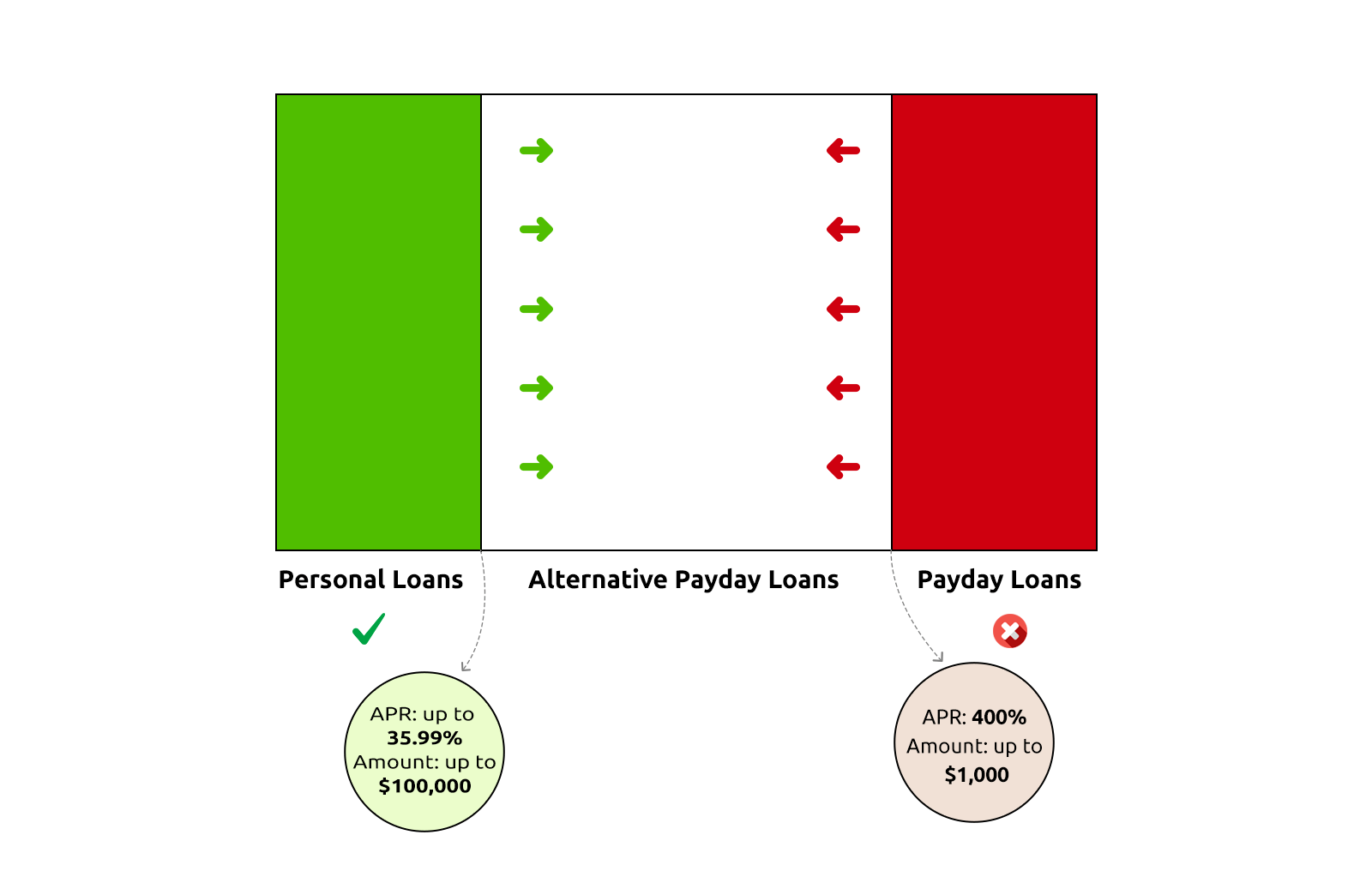

Exactly what in the event that a concept step 1 financing doesn’t work for you? If you don’t have a premier adequate credit rating having old-fashioned loans or enough security to help you qualify for a house security financing otherwise domestic security personal line of credit (HELOC), dont worry. You’ve kept many choices beyond a concept step one mortgage.

Regulators do it yourself fund and you can offers

As mentioned significantly more than, the brand new FHA 203(k) system is a similar system that can be used to invest in home improvements one costs as much as 110% of the home’s worth (after the solutions was finished).

- If you’re reasonable-income:

- HUD’s Family Resource Partnerships Program and you can Neighborhood Innovation Take off Grant Program bring finance that allow claims, locations and you can areas to greatly help reduced- and you will reasonable-money property owners rehabilitation their houses.