Their lender will additionally look at your a job updates

A career

They’re going to glance at the duration of your work, the sort of a position (full-time, self-functioning and stuff like that) and the community your work in. Loan providers generally need the earlier in the day 90 days of payslips together with your home loan application. If you’re mind-employed, you do not have the ability to likewise have this type of docume nts, and therefore are required to include other data files for example their tax returns.

You will usually need to have held it’s place in your standing for at least six months before applying to own home financing, but staying in the same work for two many years might be useful. For the reason that the lender is in hopes that you will features constant employment and therefore income when taking in your house financing. Self-functioning anybody might need to dive using a few more hoops getting approved getting a mortgage.

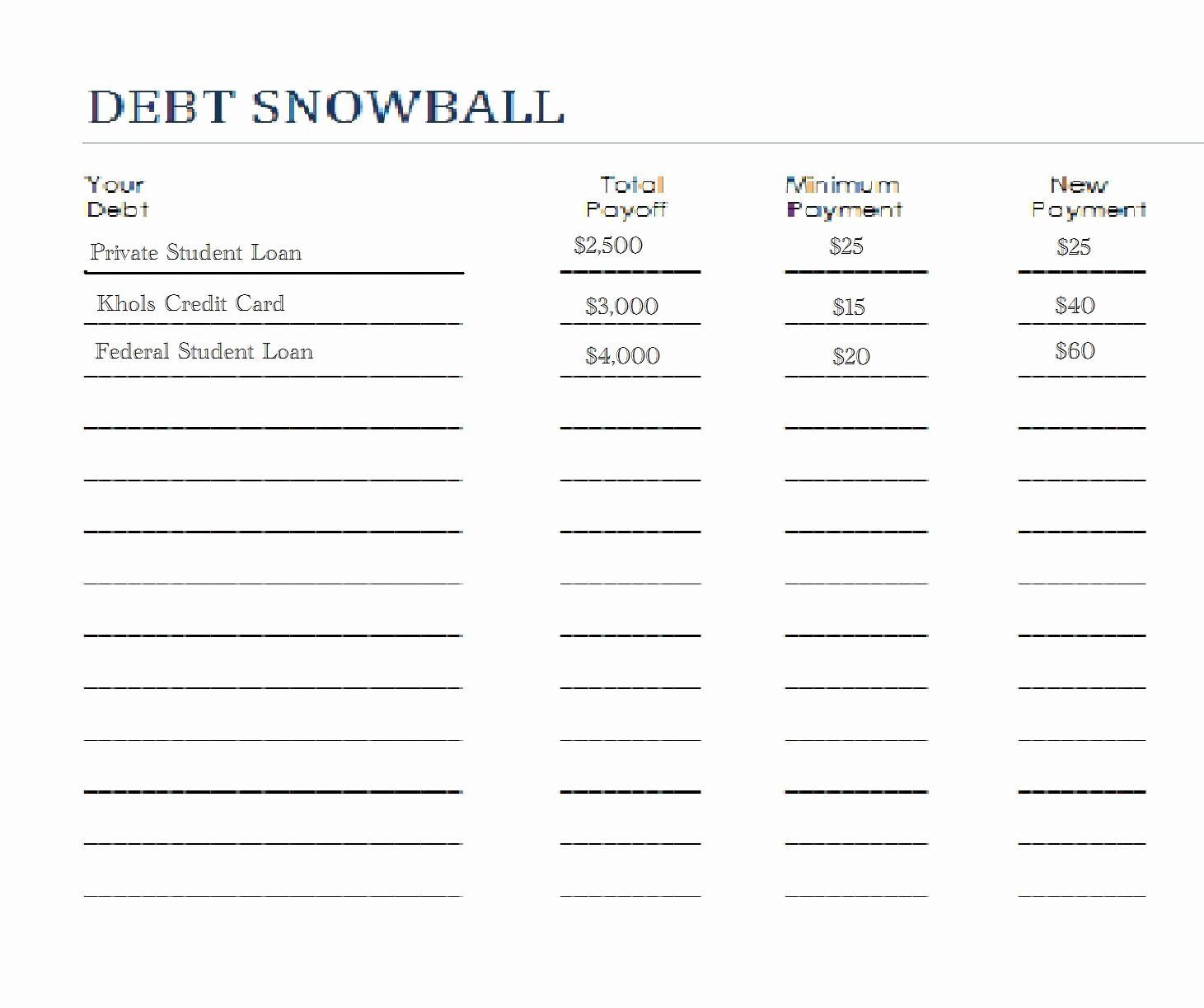

Assets and you may debts

Your financial will also account fully for your property and you can liabilities, and your month-to-month expenses, to be certain you could potentially have the ability to undertake a home loan. Possessions could include:

- Any features/possessions you own

- Quantity of trucks/vehicle you own

- Present money (car finance, personal loan, home loan)

- High mastercard restriction/s

Their lender also take into account your day-to-big date bills such as for instance restaurants, bills, recreational spending or other economic obligations. Read More