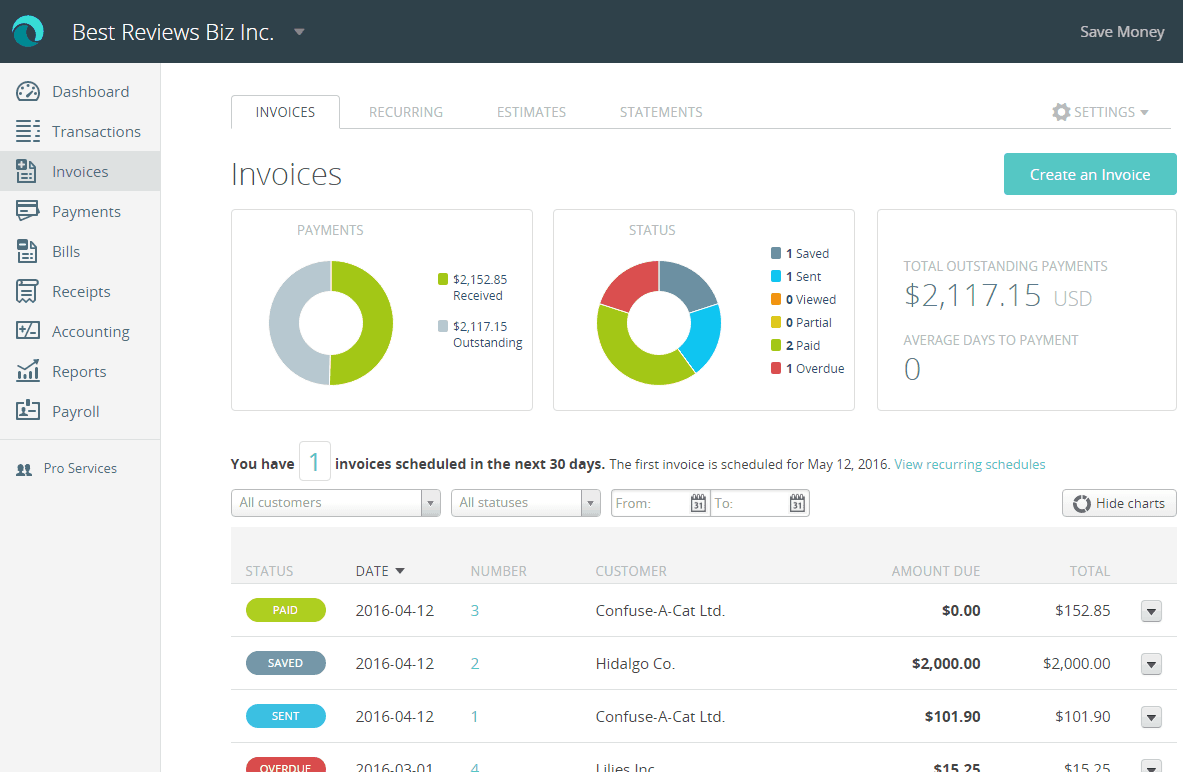

Average financing on 3rd one-fourth out of 2022 was indeed $313

0 million , growing $8.2 mil versus second one-fourth out of 2022. Mediocre commercial financing enhanced $six.5 mil motivated from the development in PNC’s corporate financial, a residential property and providers borrowing from the bank companies. Average user money regarding $98.nine billion improved $step one.seven million on account of high domestic mortgage, domestic collateral and you may charge card loans, partially offset because of the down automotive loans.

Average Federal Set aside Lender balances , mainly on account of higher funds an excellent, enhanced ties balances minimizing dumps

eight million as compared to third one-fourth off 2021. Mediocre commercial money improved $17.8 billion primarily determined of the development in PNC’s business financial and you can providers borrowing from the bank people, partially counterbalance by Paycheck Cover Program (PPP) loan forgiveness. Read More

:max_bytes(150000):strip_icc()/ss-to-sf-1000x1500-58c6f13b3df78c353cbcda66.jpg)